He once said, ‘Read 500 pages like this every day. Moreover, his annual letters to his shareholders of Berkshire Hathaway always include a couple of book recommendations. the Magellan fund averaged a 29.2 annual return and as of 2003 had the best 20-year return. Reportedly reads almost 500 to 600 pages every day. One up on wall street by peter lynch and john rothchild pdf. Reading is the trick for new investment ideas Ground Rules Mutual Fund If you do not have much time to do enough research about the companies to invest in, mutual fund is an option for small returns. This focus helped Buffett avoid burning a big hole in his portfolio during two of the biggest meltdowns in the US markets. Similarly, he kept away from banks and financials during the sub-prime crisis.

PETER LYNCH ONE UP ON WALL STREET RETURNS HOW TO

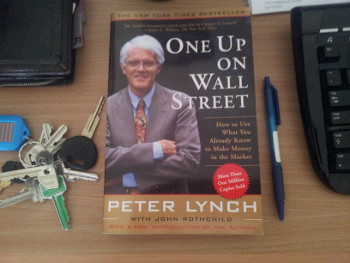

One Up on Wall Street: How to Use What You Already Know to Make Money in the. Peter Lynch offered investors deep insight in his book One Up on Wall Street.Lynch was careful to warn his readers that it was important to first. One Up on Wall Street: How to Use What You Already Know to Make Money in the. The habit of investing with your own understanding will solve half of your problems as you will then be able to spot red flags in a company sooner.īack in the late 1990s, the whole investment world was gravitating towards information technology (IT) and telecom companies, but Buffett chose to stay away as he felt it was too complex to understand. 13 Tips From Renowned Stock-Picker Peter Lynch.

One simple tip while investing is to only invest in companies/sectors/industries you understand. Peter Lynch, manager of the Magellan fund, describes how average investors can produce excellent returns by using what they already know.

0 kommentar(er)

0 kommentar(er)